Optimize Payment UX and Prevent Fraud with BIN Lookup

Handling payments well is critical to the success of any company – whether you’re looking to optimize the user experience for card-based payments, protect the security of payment card data to maintain compliance, or prevent fraudulent payments. Learn how to accomplish all of these goals, and more, without expanding your PCI compliance scope.

The first six to eight digits of a credit card or debit card number are known as the Bank Identification Number (BIN), or sometimes an Issuer Identification Number (IIN). BINs indicate which institution issued a given card. However, BINs are only valuable to businesses with the ability to parse them. Because parsing BINs without expanding PCI compliance scope can be technically challenging, many companies use BIN lookup services to validate card authenticity, detect fraudulent activities, streamline transaction processes, and more.

In this post, we’ll look at the business value provided by BIN lookup services and the security and compliance issues businesses face if they try to build a BIN lookup service themselves. We’ll also show how Skyflow’s BIN lookup service makes it easy for you to gain the benefits of BIN lookup without expanding your compliance scope.

The Value of BINs and BIN Lookup Services

BINs are assigned by networks like Visa, MasterCard, and American Express. BINs are very useful to merchants and fintech companies because a BIN can tell you a lot about a credit or debit card:

- Bank or Issuer Name

- Card Issuing Country and Currency

- Card Number Length

- Card Funding Type: Credit, Debit, or Prepaid

- Card Category (Mastercard, American Express, Visa Classic, Visa Signature, etc.)

There are a few complicating factors, though. For example, larger card issuers sometimes use more than one BIN, and some card issuers share BINs. Another complicating factor is the difficulty of parsing BINs. To look up BINs, you need to obtain BIN metadata from a wide variety of payment card networks and financial institutions through partnerships. Or, you need to use a BIN lookup service.

With a BIN lookup service, your business can enjoy a host of benefits:

- Optimized Payments UX

- Fraud Detection and Prevention

- Enhanced Payment Security

- Streamlined Operational Efficiency

- Geo-location and Targeted Marketing

- Compliance and Risk Management

Optimized Payment UX

The quality of the user experience (UX) during checkout and payment processing has a significant impact on the bottom line of any business. A seamless and intuitive UX plays a crucial role in reducing cart abandonment rates, ultimately boosting revenue. A BIN lookup service provides a valuable resource to help you craft a superior payment experience by leveraging data such as card number length, card funding type, and issuer name.

For example, if your business provides a peer-to-peer money transfer service that only accepts debit cards, you can prompt the user to choose a different card if they accidentally enter a credit card BIN, and you don’t need to wait until they have entered their entire card number to provide this prompt. On the other hand, if your business runs an online gaming service that only accepts certain types of cards, you can prompt the user to enter a different card number if they start to enter a credit card number. This is just one example of how BIN lookup helps companies to prevent payment errors.

Similarly, if your business only accepts Visa and Mastercard and a customer tries to enter a card number from another network, you can prompt them to enter a Visa or Mastercard before they enter their full card details.

A BIN lookup service also provides UX benefits like the following:

- Streamlined Form Filling: BIN lookup tells you the length of the card number associated with specific card types. This lets you design your checkout forms to adjust to the correct number of digits automatically. Doing this streamlines the checkout process, reduces errors, and saves users time and effort.

- Personalized UX: A BIN lookup service tells you which issuer is associated with a card. Businesses can provide a personalized touch by pre-populating the issuer's name in the checkout form. Users appreciate this convenience, as it helps them to identify the card they’re using if they store multiple cards with the merchant, resulting in a smoother and more efficient checkout process.

- Increased Customer Confidence and Trust: A seamless and intuitive checkout experience instills confidence in users and cultivates trust in your business. When customers feel comfortable during the payment process, they’re more likely to complete their transactions. This increased trust and confidence leads to higher conversion rates and ultimately drives revenue growth.

- Error Prevention: As discussed above, real-time BIN lookup helps prevent users from trying to use unsupported card types.

As you can see, using a BIN lookup service prevents user frustration and lets you prevent order abandonment by guiding users throughout the checkout process.

Fraud Detection and Prevention

BIN lookup services play a vital role in identifying and preventing fraudulent activities. By cross-referencing BIN data your businesses can verify the legitimacy of payment card numbers and promptly detect suspicious patterns or inconsistencies. This lets your business make more informed decisions about whether to accept a payment or flag it for further review.

This capability improves security and protects your businesses and your customers from potential risks.

Enhanced Payment Security

By integrating a BIN lookup service into your workflows, your businesses can enjoy improved payment security.

With BIN lookup, you can identify potentially risky transactions, such as high-value purchases from unfamiliar locations. Your business can also use BIN lookup to implement additional authentication measures so you can validate cardholder identities and prevent unauthorized purchases.

Streamlined Operational Efficiency

With a BIN lookup service, you can streamline your payment processes.

Retrieving card information using BINs lets you auto-fill certain details during checkout, such as card brand and type, and card number length. This not only improves transaction speed but also minimizes errors, enhancing overall operational efficiency.

Geo-location and Targeted Marketing

Knowing your customers is critical to the success of any business. With a BIN lookup service, you gain access to geographic information that provides insights into customer demographics and market segmentation.

Equipped with this data, your business can drive customer engagement and loyalty using targeted marketing campaigns tailored to specific regions, issuers, or customer groups.

Compliance and Risk Management

With a BIN lookup service, you can more easily comply with regulatory requirements such as anti-money laundering (AML) and Know Your Customer (KYC) regulations. By providing an additional layer of verification, BIN lookup services empower businesses to perform due diligence and effectively manage associated risks.

The Challenges of Implementing BIN Lookup

If your business has offloaded PCI compliance, then it can be difficult to integrate BIN lookup into existing payment processing systems. After all, if you aren’t directly handling payment card numbers, then running analytics against them can be very difficult.

And, even if your business is handling PCI compliance with minimal assistance, gathering the data required to run your own BIN lookup service from multiple sources and keeping this data up-to-date can be expensive and technically challenging, requiring significant development resources and expertise. You’ll also need to make sure that your payment processing systems are compatible with BIN lookup and that the solution is implemented correctly to avoid any disruptions to payment processing operations.

And, as with any project that handles PCI data, you need to take extra measures to maintain PCI compliance and protect the security of payment card data.

But what if you could enjoy the benefits of BIN lookup without directly handing PCI data, or expanding your compliance scope? That’s what Skyflow’s BIN lookup service provides

Skyflow’s PCI Solution and BIN Lookup Service

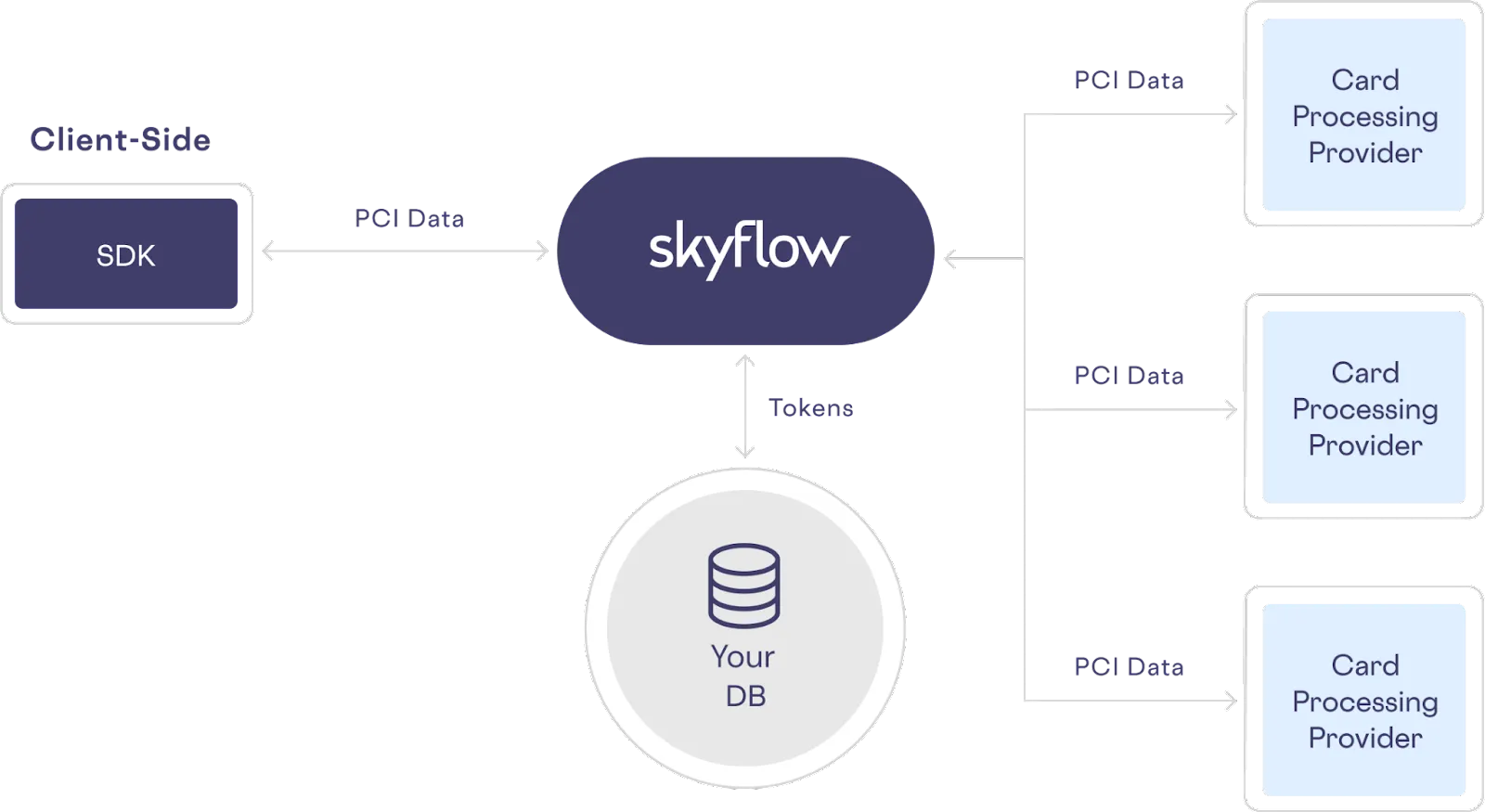

Skyflow Data Privacy Vault eases PCI compliance by isolating, protecting, and governing PCI data in a vault that’s designed for the express purpose of protecting sensitive data without sacrificing data use.

With Skyflow, you can remove all card data from your systems and business processes and replace that card data with tokens, significantly reducing your compliance scope. This makes Skyflow an effective way to accelerate your PCI compliance timeline.

With your PCI data stored in Skyflow, you can use Skyflow’s built-in BIN lookup service to optimize payment UX, prevent fraud, and more using our simple but powerful APIs.

And because PCI data, including card details, remain safely isolated in your vault, your scope of compliance isn’t impacted by integrating BIN lookup capabilities into your payment processing and other workflows.

As your company grows and your PCI compliance requirements increase, you can continue using Skyflow to protect PCI data and look up BINs while orchestrating payments across vendors.

Try Skyflow

With Skyflow Data Privacy Vault, you not only have a fast and easy way to reduce PCI scope and more rapidly achieve PCI compliance, you can also enjoy the many benefits of BIN lookup.

Skyflow can handle any type of sensitive data, so beyond using it to take control over your PCI data, you can also use Skyflow to ease compliance with any data privacy law, including HIPAA, GDPR, and CPRA.