CFPB Finalized Rule 1033 to Protect Data Privacy: What to Know

The CFPB 1033 Rule is a regulatory framework introduced by the Consumer Financial Protection Bureau (CFPB) to give consumers greater control over their financial data. This post explores the requirements and how a data privacy solution like Skyflow can help you ensure compliance without sacrificing efficiency or security.

As an engineering or product leader in financial services, you already know the importance of data security and compliance. Now, your responsibility will expand with the CFPB 1033 rule – a regulation born from the Dodd-Frank Act. The CFPB 1033 rule mandates that consumers have the right to access and share their financial data with third parties, such as fintech apps or financial service providers. While this opens up new possibilities for consumer empowerment and innovation, it brings heightened security requirements that cannot be ignored.

The regulation requires that financial institutions provide access to consumer data and ensure that the data is securely shared and managed. This aspect of the legislation places a critical burden on product and engineering teams to build systems that meet these requirements while protecting sensitive financial information.

CFPB 1033 and the Focus on Data Security

The key focus of the CFPB 1033 Rule is consumer control and transparency. Data security is embedded within the regulation to ensure that as consumers access and share their financial data, it is done securely and responsibly. Here are the security mandates engineering teams need to address:

- Secure Consumer Data Access: Financial institutions must allow consumers to access and share their financial data with authorized third parties securely. This includes account details, transactions, and personal identification data that, if exposed, could lead to identity theft, fraud, or other security breaches.

- Data Protection During Transfer: Under CFPB 1033, data transfer to third-party apps and fintechs must happen securely. This requires encryption during data transmission to prevent interception or exposure of sensitive data while it's being shared across systems.

- Data Transparency and User Control: Institutions must provide transparency about how and where consumer data is used. Consumers should be able to control which third parties receive their data and be informed about those third parties' privacy practices, further emphasizing the need for privacy-preserving architecture in data-sharing systems.

- Minimizing Data Exposure: The regulation calls for institutions to limit exposure by ensuring data minimization. This means that third-party services should only have access to the data necessary to provide their services, and no more. Full access to raw financial data should be prevented to reduce the risk of misuse or breach.

- Ongoing Monitoring and Security Audits: Institutions must implement continuous monitoring and provide auditable records of who accessed the data and for what purpose. This is necessary to ensure compliance with CFPB 1033 and mitigate any security risks.

What is Skyflow?

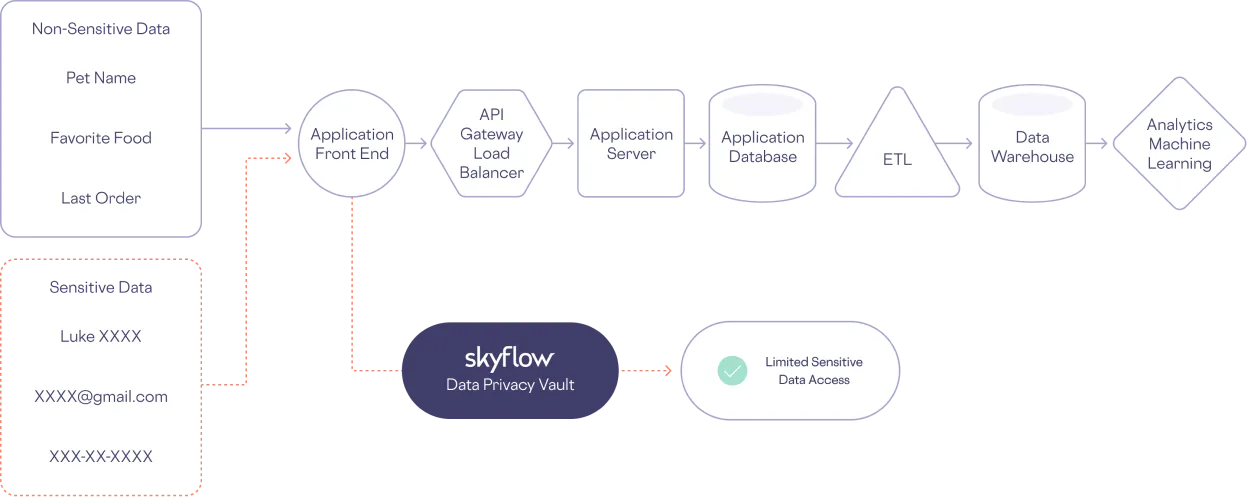

Skyflow provides customers with data privacy vaults, a secure and scalable solution for managing and using sensitive data such as PII and PCI.

The data privacy vault architecture, initially developed by tech giants like Apple, Google, and Netflix, was designed to tackle the challenge of securing sensitive information while staying compliant with fast-evolving data protection regulations. Recognized by the IEEE as the recommended approach for securing sensitive data, the vault isolates and protects information using advanced encryption and tokenization, and offers fine-grained access controls to ensure privacy and regulatory compliance.

Skyflow empowers developers at companies of all sizes to implement a cutting-edge Data Privacy Vault without the hefty investment of building and maintaining one in-house like what Shopify built internally.

Addressing CFPB 1033’s Requirements with Skyflow

As an engineering leader, you face the challenge of maintaining compliance with CFPB 1033 while safeguarding your organization’s reputation against data breaches and regulatory penalties.

Skyflow’s Data Privacy Vault takes the heavy lifting out of building secure data-sharing systems, and here is how you can use Skyflow to address the key responsibilities of CFPB 1033:

Secure Consumer Data Access

Skyflow ensures that only authorized parties can access and share consumer financial data securely. By implementing fine-grained access controls, Skyflow helps enforce strict rules on who can view or share data. This access can be tailored precisely to the consumer’s consent and institutional policies, thereby aligning with CFPB 1033’s emphasis on secure consumer data access.

Data Protection During Transfer

Skyflow’s advanced encryption methods, including patented polymorphic encryption to enhance data security. By encrypting information in multiple forms customized to specific functions, Skyflow ensures that sensitive data remains secure throughout its transfer between systems. This tailored approach protects data integrity and maintains high performance, enabling secure data movement without sacrificing speed or efficiency.

Data Transparency and User Control

Skyflow supports data transparency by enabling institutions to manage consent and provide visibility into how and where consumer data is being shared. This helps you meet the CFPB 1033 requirement to inform consumers about third-party data practices and give them control over their information. Skyflow’s architecture makes it easy to implement a user consent management interface that aligns with the rule’s transparency mandates.

Minimizing Data Exposure

The regulation emphasizes minimizing the amount of data shared with third parties. Skyflow facilitates this by providing data tokenization and masking, reducing the risk of unnecessary data exposure. This ensures that third-party applications can access only the specific data they need to perform their functions, without gaining access to raw financial information.

Ongoing Monitoring and Security Audits

Skyflow’s comprehensive audit trails allow institutions to monitor and report on data access in real-time. This supports continuous monitoring and enables institutions to provide auditable records of data access, helping them stay compliant with CFPB 1033 and other regulatory requirements. This built-in auditability is key to identifying and mitigating potential security risks proactively.

Bonus: Built-in Zero-Trust Security Model

Skyflow employs a zero-trust security model that treats all internal and external entities as untrusted by default. This model aligns with the CFPB 1033 rule’s emphasis on rigorous security standards, as it limits access based on strict verifications and permissions.

Using Skyflow, your engineering team can meet the regulatory demands of CFPB 1033 while focusing on innovation and delivering seamless customer experiences. Skyflow ensures compliance and strengthens your security posture, enabling your organization to navigate the new data-sharing landscape confidently.

Final Thoughts

The CFPB 1033 Rule introduces a new era of consumer financial data access and sharing, but it also heightens the need for secure data practices. Ensuring that your systems are compliant, scalable, and secure is critical to protecting your institution and customers. Skyflow’s data privacy vault provides the perfect solution for meeting CFPB 1033’s data security requirements, offering encryption, tokenization, access control, and auditability in a single, easy-to-integrate platform.

With Skyflow, your team can focus on building the future of financial services while ensuring that sensitive consumer data remains secure, compliant, and fully protected. To learn more about how Skyflow can help your organization enhance its data protection strategies, visit Skyflow for Payments.